The D2C Survuval Trap

No matter how many years you have spent building a D2C brand to generate revenue and grow profitably, you are probably well aware of the statistics that around 50% of startups fail within the first five years.

They don't tell you that those failed entrepreneurs are the lucky ones! Most D2C brands are stuck in debt. The leaders were frustrated with less cash flow and were fighting to pay the bills. They even pay with their personal finances. They collapse everything and live stressed.

Even if the idea is great, they worry about social validation. Humans naturally look for approval from others and want to be seen as successful, not fail.

I have worked with 40+ D2C brands. Entrepreneurs with more than 25% expense with marketing are living in a financial nightmare.

The ideal marketing expense must be less than 25%. This makes you make the profit & cash flow smoother.

You start your work early and continue for long hours after the sun goes down. You work with the packing team and accounts, creating & running ads.

Your restless work doesn't free you; It further drains you. Doing all these things & not having consistent revenue and profit makes you exhausted.

If you think you are the one who survives & struggles with cash flow, not others. You are not alone.

Since I worked closely with D2C founders, I noted that when sales dropped or expenses increased temporarily, leaders worried about who had cash flow issues and not about who had the previous profit with them to pay the bills.

Even the big brands that seem top in the industry are 1-2 bad months away from total collapse.

A couple of years ago, one of my clients gave me a wake-up call. They were generating 4cr/m and 40+cr ARR.

He mentioned the sales drop may happen due to various external factors we don't control. But, we should be looking at what we have & stability.

Nowadays, brands are very hype. They look good outside but don't make you where you want to go.

It is like wearing a luxury dress outside and looking cool but not feeling the inner peace and constantly thinking about the next bill.

Growth Problems

You have probably put a lot of work into growing your business. You are good in your industry & have products people love to use. That's great. And that's surely a must-have in the earliest stage to stand out from the crowd.

However, growing revenue without stability still kills your brand over a period of time. Most small e-commerce stores are shut down in less than 5 years.

In this article, you can master the growth with stability & profit. not just run, but THRIVE.

Sales Stability (marketing cost less than 25%) is the foundation. Without generating consistent sales, we can't take our product & message to the target customers. Without profitable sale, we are slaves to the brand and keeps worrying getting sales today or how can I sustain and pay next bill.

We started building the brands to be free from time & finances. But it sucks the life.

You need Cashflow.

Cashflow needs consistent revenue.

Consistent revenue needs brand stability.

Growth problem occurs only when any of the below problems occur:

- Sudden Sale Drop: The problem occurs when you run your brand month to month pay check and sales are slowing down. When sales momentum is not there or some issue with ads or website, sales drops automatically. You will not have enough cashflow to pay the expenses.

- Sales Speed up: Sometime, your revenue & ROAS looks good. You will aim to scale your ad spend to increase the orders. As your revenue increases, quickly expenses, ad spend, cancel orders, RTO increases. Your top revenue may look great & your expenses match the sales. Bottom profit not increased. This happened due to your advertising cost. Overspend on ads burns cash.

Sound familiar? Over the last 8 years, I have seen founders at every level of growth who focused more on short-term revenue, month to month paycheck methodology is more common than you realise.

Scaling Topline revenue is not better.

Why is success constantly defined by having the topline revenue? Does more revenue mean you are more successful? Does more revenue mean more profit? No.

I know far too many D2C early-stage brands that generate ₹ 1– 5Cr per year are in a panic and spending their personal money to sustain the brand. Is that success? Not really.

Growth is a battle for entrepreneurs. Grow! More sales! More customers! What is the end? More significant sales or growth means a bigger problem, for sure. It doesn't guarantee better cash flow and profit.

The constant sales without concern for stability makes you fall one day when your sales drop & run out of money.

I have good news. I created BRAND GROWTH so you don't have to start from scratch like I did.

Perfect revenue growth & cash flow happen naturally when you have the right marketing mix and build a brand.

Top 3 Factors for better cash flow & profit. Faster Growth to 10cr.

- Product Giant seed:

To successfully build a profitable bootstrapped brand, you need to start with a product that is 10 times better than the market.

Don't waste your time selling products already in the market. This may or may not work. Launch and scale the product you know has the best chance of scaling. Then, you can focus your time, money, and attention on growing the brand.

A product differentiator is your sweet spot, where people love to buy from the beginning. This helps you reduce marketing costs as you get higher ROAS on advertising campaigns.

- Marketing Expenses Less than 25%:

Most brands use aggressive ad spending to drive sales, but once they scale, margins shrink, and profitability suffers. The key to sustainable growth is keeping marketing expenses below 25% of revenue.

I understand that achieving this is difficult when you depend on performance marketing only. But this will be a sweet spot where the brands take the cash flow smoother. In the previous edition, I wrote about how balancing the brand and performance marketing can have significant growthI understand that achieving this is difficult when you depend on performance marketing only..

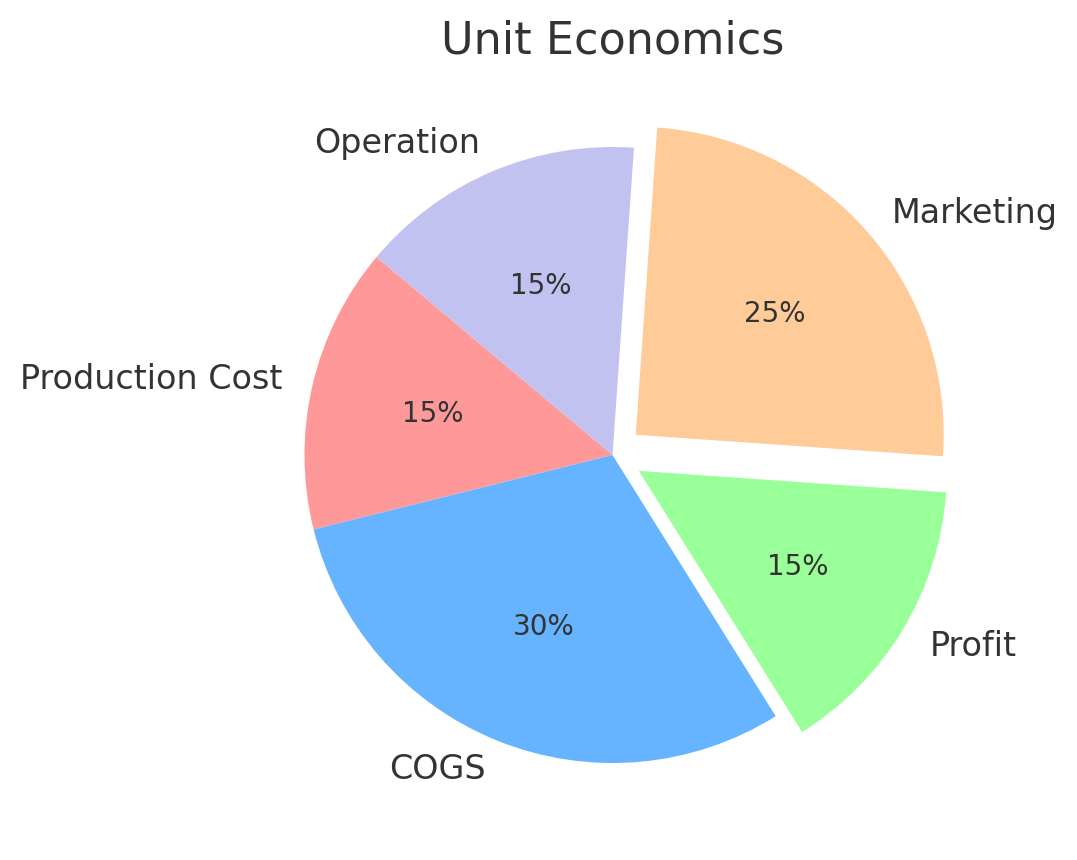

When you optimize your marketing cost by less than 25%, your unit economics looks like this:

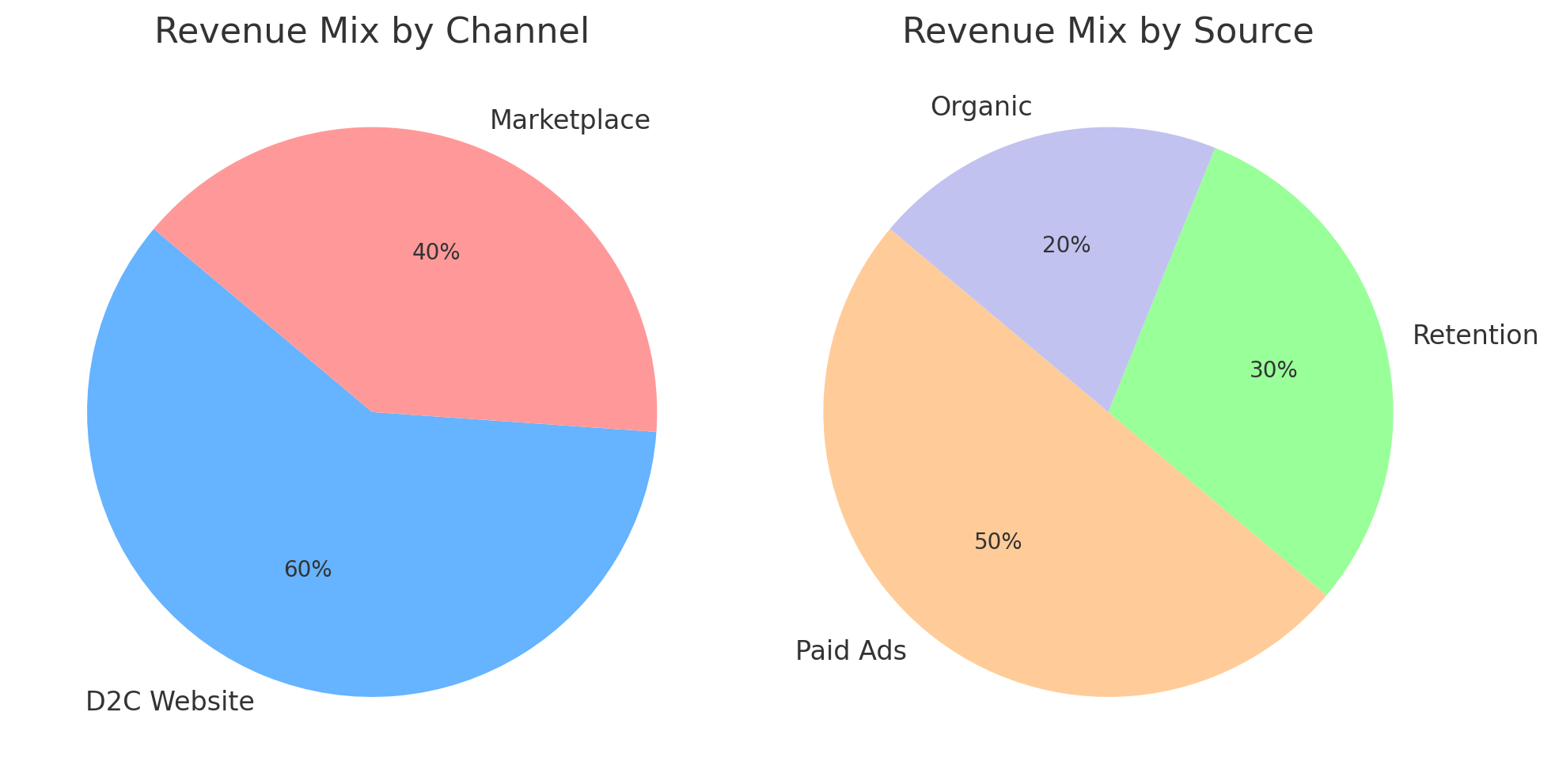

- Right Revenue Mix

You scale with ads. 10% more spending = 10% more sales. Feels like magic—until it stops working. Costs rise, ROAS drops, and margins shrink.

Smart brands avoid this by having the right revenue mix.

This means lower CAC, higher LTV, and predictable growth.

Ask yourself: If ads stop today, will your brand grow tomorrow?